An economic recession isn’t like the winter solstice or the summer olympics. There’s no firm date on the calendar marking an official beginning (or ending) to a recession, and we don’t really know we’re in one until… well, until we’re in one. But by all indications, that’s where we’re headed right now halfway through 2022.

So what to do? For would-be home buyers, it’s natural to feel a healthy sense of trepidation about making the largest purchase of your life during an economic downturn. But are those fears well-founded?

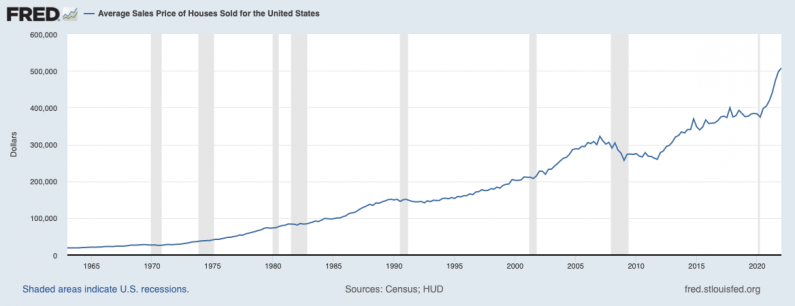

The short answer is no. The housing market — though it gets a lot of media coverage at every turn, up or down — is one of the most historically safe investments you can make. Real estate values have continued to increase despite numerous recessions over the last half century. In some cases, home values have even gone up during the recession itself.

Homebuyers and investors alike should take comfort in this well established trend. And because the numbers don’t lie, you should do more than just take comfort… you should take advantage of the opportunities available now in the housing market. Here are three reasons why betting on housing during a recession could pay off well in the long term.

1. Historically, real estate is one of the safest investments you can make.

Real estate is one of the most stable investments when the economy is shaky. Why? Because housing is a basic need. When money gets tight, people may put off their vacations or new car purchases, but no one is going to voluntarily live on the streets. The demand will always be there, which serves as one of the strongest economic drivers of steady growth.

At the beginning of a recession, home values may dip momentarily, which only provides a better case for staying on the hunt for a new home. Now may be the best time to get the best deal on a new home.

2. Home prices bounce back quickly after the recession ends.

The only recession in the last 60 years to really hit the housing market hard was in 2008. But even then it wasn’t long lasting. By about 2013 values had fully recovered and were well on their way up. Many causes of that particular recession were directly related to the housing market, and many lessons were learned — and many protective regulations were put in place to prevent it from happening again.

If you’re in the market for a new home and plan to stay in that new home for more than just a couple of years, your investment in that piece of real estate should follow the same trend indicated by the graph above. This is the cornerstone of “The American Dream”… home ownership has and will always be a great vehicle for overall financial well being.

3. The “If you can afford to buy, buy NOW” rule holds true regardless of economic conditions.

Any realtor will tell you, if you’re ready to buy, able to buy… you should buy now. Why? The same reason as above — home values, over the long-term, always go up. What you can afford to buy today may be out of reach tomorrow. The market can change quickly, especially during times of economic uncertainty.

But again, the global market is not representative of the strength of the housing market. Don’t let the stock market volatility fool you into thinking ALL investments are risky. Investing in a home is almost always a smart, safe option for those ready, willing and able to buy.

Recent Comments